In 2008, Neumann and Miguel McKelvey, two co-founders of WeWork, founded Green Desk. Green Desk provides sustainable joint office space with recyclable furniture and green office supplies. Although the real estate market was in the doldrums at that time, green table companies flourished. After that, the two founders realized that it was not the concept of "sustainability" that attracted people to the Green Table Company, but to share the office. In 2010, they sold their shares in the Green Table Company and founded WeWork.. Over the next two years, WeWork opened four new homes Office space, and attracted the attention of the top venture capital company Benchmark. With Benchmark's investment, WeWork will have 1.5 million square feet of office space and 10000 members by 2014. With the influx of more venture capital, the number of WeWork office space has soared. In 2014, WeWork left the United States and opened its first international office space in London. In 2017, WeWork's 200th office space officially opened. In the same year, Wework accepted 4.4 billion dollars from Sun Justice. Yuan investment, and began the crazy expansion of the road.

WeWork was founded in 2010 to provide shared office space for entrepreneurs, freelancers, small businesses and large company employees. In the past 9 years, WeWork has risen rapidly. WeWork now covers 32 countries and regions, with a total of 270000 members, almost synonymous with "shared office." WeWork has always been proud of the business model of shared office space, transforming long-rented office space and renting it again to earn intermediate differentials. This business model is not complex, but all this is different when WeWork is added to the aura of "shared office ancestor" and "subverting traditional office buildings".

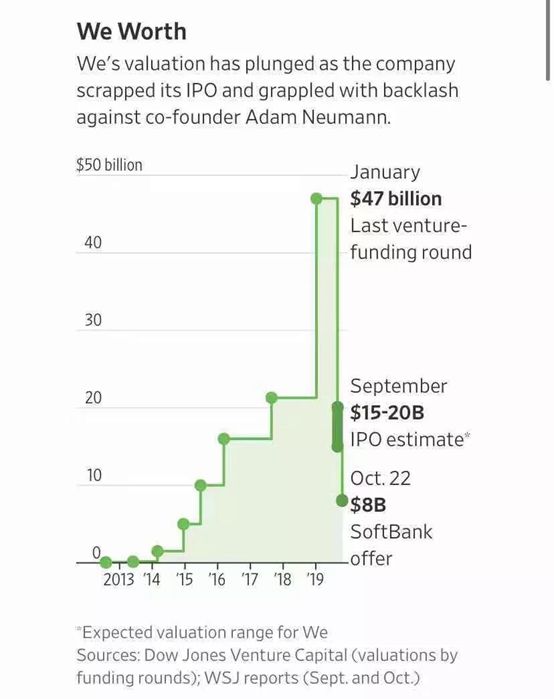

In December 2018, WeWork secretly filed an IPO application in the name of We Company. Four months later, Neumann announced it. In January this year, Softbank Corp invested $2 billion directly in WeWork. At the time, WeWork was considered by the market to be a super unicorn, valuing it at as much as $47 billion. But with the gradual release of the IPO, investors are questioning the super-unicorn. WeWork's revenue from 2016 to 2018, according to the WeWork prospectus, is $436 million, $886 million, and $1.821 billion, respectively. But at the same time, WeWork's net loss also expanded from $429 million to $1.927 billion. After 2019, the net loss remained unchanged. In the first half of 2019, the company had a revenue of about $1.5 billion, up from $760 million in the same period in 2018; a net loss of $900 million, up from $720 million in the same period in 2018, up by 25% on a year-on-year basis. WeWork said in its IPO statement, "In the long run, although we do not think the net loss as a percentage of our income will increase, it is likely to increase in the short term and will continue to grow in absolute terms. "But these statements do not ease the concerns of investors. Sanford C. Bernstein analyst Chris Ryan," WeWork needs to be $7.2 billion in cash in the next four years to turn the cash flow forward. And if there is a recession by 2022, the money it needs will be raised to $9.8 billion. "

Now Marcelo Claure, chief operating officer of Softbank Corp., has replaced co-founder Adam Neumann as the new chairman of WeWork, and the board will add more members. WeWork's future development and market valuation depend on Softbank Corp to guide. Morgan Stanley's chief U.S. equity strategist, Mike Wilsons, in a report to investors: "The failure of WeWork IPO marks the end of an era in which 'even companies can get huge market valuations even if they are not profitable'."

According to CNBC, on October 22, the Soft-Silver program, plans to invest $4-5 billion in WeWork, which is about to dry up the cash flow, and the corresponding WeWork is valued at $7.5 -8 billion, leaving only 17% of the $47 billion valuation at the beginning of the year. Softbank will hold over 70%. In addition, in order for Adam Neumann, the founder of WeWork, to give up control over WeWork, Softbank will pay $1.7 billion in compensation to Nenman, including $970 million in equity, $185 million in consulting fees, and $500 million in credit.

In July, WeWork shares received two sellers' quotations, both worth $15 million and selling at $61 and $54, respectively. If the deal is established, WeWork will be valued at $26.1 billion and $23.1 billion, respectively. That is a far cry from its $47 billion valuation, which has been described by the media as "halving". On October 1, WeWork officially issued a statement that it would formally withdraw its IPO statement to the Securities and Exchange Commission and postpone the company's IPO. The once dazzling super unicorn finally failed to stand on the bell stage as desired.

(Picture Source:Sogou)